Investosquare.com: Redefining Mutual Fund Investing with Research-Driven Simplicity

Aug 02, 2025

VMPL

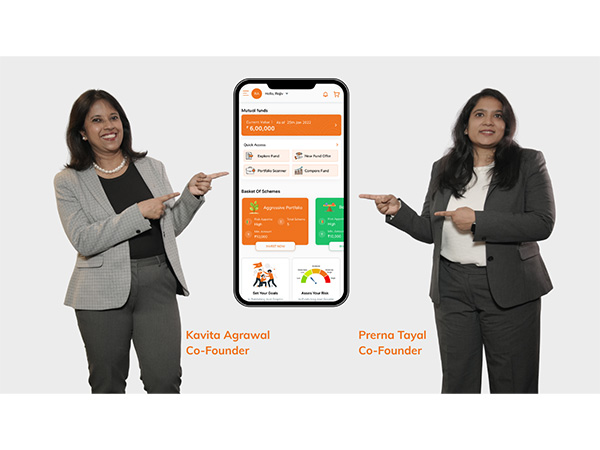

New Delhi [India], August 2: With the fast-evolving fintech ecosystem in India, Investosquare.com has gained popularity as one of the potential names in mutual fund investing, providing a platform that has combined technology with profound financial understanding. It is a bootstrapped venture co-founded by tech guru Prerna Tayal and finance expert Kavita Agrawal, changing the way normal investors manage their personal finances in a world that no longer requires the hype and overused jargon.

Empowering Everyday Investors with a User-Friendly Platform

The success of Investosquare is that they believe in the philosophy of making mutual fund investing smarter, simpler, and accessible. It is intelligently designed to suit the needs of any type of investor, be it a beginner or an experienced one, and provides features that include comprehensive portfolio analysis, scheme comparisons, handpicked research, and personalized goal planning all available in a single online platform. Investosquare holds the position of being easy to use and understand, doing away with the confusion usually met on mutual fund platforms.

Led by Two Experts: A Blend of Tech Innovation and Financial Wisdom

Prerna Tayal is a highly skilled engineer who has worked with some of the most prominent companies in development efforts including Wipro, Capgemini, Ness Technologies, and TraceLink, with more than 16 years of experience. Her experience in developing complex technological systems is also vital in realizing the ease of use, safety, and other relevant aspects of the platform. According to Prerna, technology ought to make people more powerful and not make them feel confused and that philosophy can be seen in each feature and each part of the design of Investosquare.

The business and investment strategy wing is headed by Kavita Agrawal, who is a Chartered Accountant with almost 20 years of experience dealing with taxation, financial planning, and advisory. Her experience, as well as her view on serving the client, has formed the advisory model of Investosquare, which is data-based yet humane at the same time. Being a finance professional from a small town, Kavita emphasizes that while investors rely on numbers, they also need trustworthy guidance to make informed decisions.

The Phygital Edge: Tech Meets Human Insight

Investosquare can also be characterized as a hybrid model, which is called a "Phygital Approach" by its founders. The combination of both physical advisory services and digital options allows investors to get the necessary analytical help as well as have close human contact with the advisors whenever they feel comfortable with it. This dual strategy helps the company serve the individual needs of Indian investors as per their age groups, experience levels, and investment goals and requirements.

Investosquare is a platform that offers many features that help investors make informed decisions. A mutual fund research engine, real-time portfolio scanner, and every other detail are geared towards providing relevance and clarity. By helping them plan retirement, the education of their children, or wealth creation, the platform assists users in making sound decisions by suggesting what works and what does not and enables them to track their progress towards their nearest goals.

Built on Passion, Growing with Trust

Although the platform itself says more than a thousand words, the fact that the founders themselves gave up their successful careers and bootstrapped their own vision is what lends huge credibility to the startup. Instead of finding external sources of financing, they used their life-savings in creating a product that can solve the actual needs in investment decision-making. The outcome is an efficient, transparent solution based on a combination of technical accuracy and financial responsibility.

Investosquare is now emerging as a trusted platform in Indian mutual fund investment. It is not a sparkling something it promises but is focusing on helping its consumers achieve smarter financial existence. Investosquare.com has a clear vision of having one of its pillars in the digital investment industry of India, and with its vision of transcending boundaries of research, usability, and customer trust, it is on a straight road towards cementing its reputation in the field.

Discover Investosquare and follow them for smart investing tips and updates: Website | Instagram | Facebook | LinkedIn | YouTube

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same)